There's a 60-70% chance of selling to someone who already bought from you, but only 5-20% for new people. That's what Forrester Research found in 2024. But most sales teams? They're still emailing everyone and hoping something sticks.

My neighbor runs a software company. Last week he goes: "We're spending like $40 to $300 per lead based on what everyone else pays, but half these people never call us back." Know that feeling? That's because he's playing the numbers game instead of the smart game.

Here's what sucks: 69% of salespeople don't hit their targets according to UpLead's 2025 numbers. And HubSpot says only 21% of B2B leads actually buy something. That means 4 out of 5 just... disappear.

But what if you knew which local businesses would spend 3x, 5x, even 10x more money with you over time? What if you could spot your best future customers before spending anything to get them?

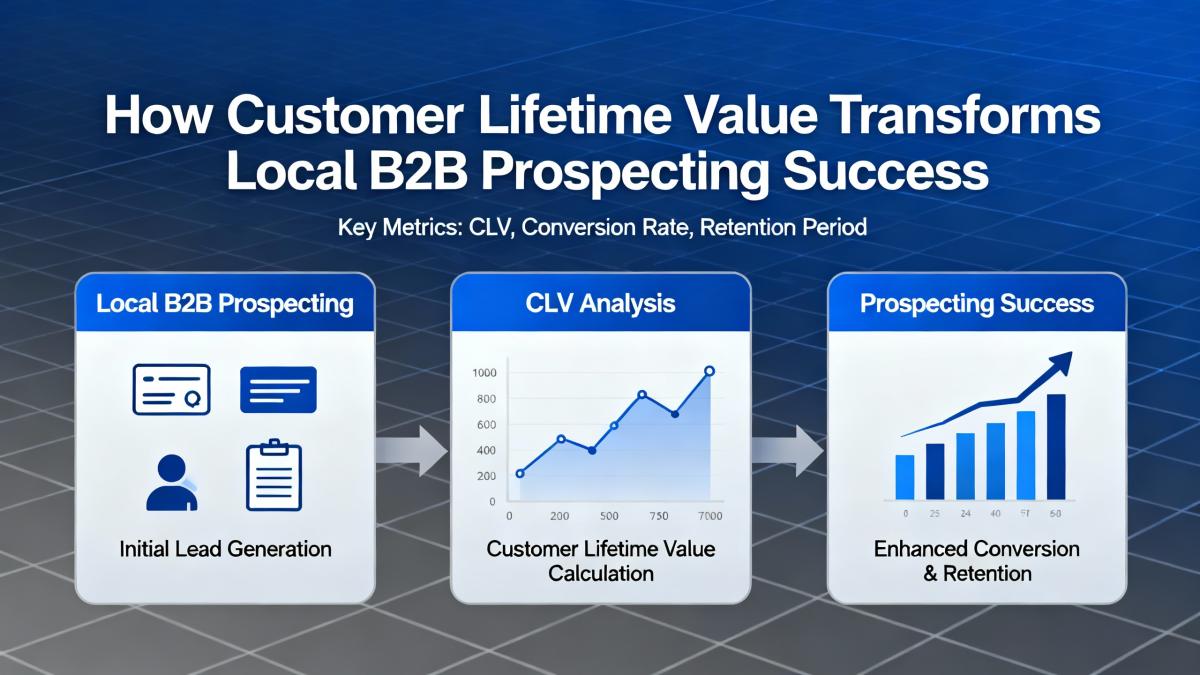

That's where customer lifetime value totally changes how you find local B2B customers.

What is Customer Lifetime Value in B2B Prospecting?

Customer lifetime value (CLV) is basically how much money a business will give you total. Not just their first purchase – everything they'll ever spend until they stop being your customer.

Simple example: A local marketing agency pays you $2,000 a month for software. They usually stick around for 3 years. Their CLV? That's $72,000. Pretty good for one customer, right?

CLV vs. Customer Acquisition Cost (CAC)

Here's the thing. What you spend to get a customer (that's your CAC) needs to make sense compared to what they're worth. Most people say you want at least 3 to 1. So if you spend $5,000 to get a customer, they should bring in at least $15,000 total.

Problem is, most B2B companies have no idea what their CLV actually is. They're guessing. They spend the same amount trying to get a $10,000 customer as a $100,000 customer. That's dumb. Really dumb.

The B2B Difference: Why CLV Matters More Locally

B2B isn't like selling shoes online. CustomerGauge says in 2024 that B2B customers usually stick around longer than regular consumers. When you work with local businesses, these relationships can last years. Sometimes forever.

Plus, local businesses talk to each other. Get one law firm downtown, and suddenly three more are calling you. That's what happens when businesses are close together – something you miss when you're trying to sell to everyone everywhere.

Why Local B2B Prospecting Benefits from CLV Analysis

Geographic Targeting Precision

When you figure out CLV by location, cool stuff happens. Maybe Miami businesses are worth 40% more than Jacksonville ones. Or tech companies in Silicon Valley stay twice as long as Portland ones. This changes everything about where you spend your time and money.

Using the best B2B lead generation platforms in 2025, you can mix CLV data with location info to target exactly who you want. No more random emails to everyone.

The cool part about local stuff? You can literally extract all businesses from a specific city on Google Maps and figure out their potential value based on what they do and where they are. We're talking about 200 million businesses you can find on platforms like Scrap.io.

Relationship-Based Sales Cycles

Local B2B sales are different. They're about knowing people, trusting each other, sometimes meeting for coffee. Look at lawyers – they pay £501.85 per lead but only 7.4% become customers. These relationships take work.

But check this out: if you know a local law firm could be worth $250,000 over 5 years, suddenly that expensive lead makes sense. You're not thinking about next month anymore – you're thinking years ahead.

Community Network Effects

Adobe found something cool with their scoring system. They figure out who's most likely to buy what. In local markets, this gets even better because businesses talk.

Google says if the 80/20 rule works for you, 80% of your money comes from 20% of your customers. With local B2B, that 20% usually lives in the same area. One happy customer in a business park can get you five more.

How to Calculate Customer Lifetime Value for Local B2B

Simple CLV Formula for B2B

Let's keep this simple. Basic CLV math looks like:

CLV = (Average Money per Customer × Profit Margin %) ÷ How Many Leave

But for local B2B, I like this better:

CLV = (Average Contract × Number of Purchases × How Long They Stay) × Profit Margin

Say you're going after accounting firms. They pay $3,000 a month. They usually buy 3 extra things. They stay 4 years. You keep 70% as profit.

CLV = ($3,000 × 12 months × 4 years) × 1.3 (for extra stuff) × 0.70 = $131,040

That's six figures from one local business. Now you know how much you can spend to get them.

Advanced Predictive CLV Models

For people who love data, predictive CLV uses old patterns to guess future value. These look at:

- How long businesses in that industry usually stay

- When they buy more stuff

- How developed that local market is

- How many competitors are around

- If the local economy is good or bad

Financial companies are great at this. They pay £504.94 per lead because they know exactly which ones are worth it.

Tools and Technologies for CLV Tracking

You don't need to be a genius to track CLV. Today's tools make it easy:

CRM Systems: HubSpot, Salesforce, whatever – they can calculate CLV automatically once you set them up right. Just make sure you're tracking all the money correctly.

Automation Stuff: With complete CRM automation using Google Maps data, you can update CLV numbers automatically as new info comes in. You'll see patterns you'd never catch yourself.

Dashboard Tools: Mix your CRM data with Make.com's automated lead generation systems to see CLV in real-time. No more guessing.

Data-Driven Local Prospecting with CLV Insights

Identifying High-Value Prospect Segments

Get this: 95% of B2B marketers say setting appointments works for getting good leads, says ViB Tech 2024. But which appointments should you actually care about?

Look at your current customers and you'll see patterns:

- Marketing agencies going after businesses with crappy websites have 3x higher CLV than normal customers

- Software companies using targeted lists see longer sales processes but way more money long-term

- Law firms in industries where trust matters charge more and keep clients forever

Using Google Maps scraping to get complete business data, you can find similar businesses in new areas that match your best customers.

Geographic Heat Mapping by CLV

Picture a map of your city where neighborhoods light up based on how much customers there are worth. That's not fantasy – smart companies do this now.

Mix CLV data with location info and you find gold. Maybe that industrial area has businesses worth twice as much. Or downtown companies leave faster even though they pay more at first.

This changes where you send your salespeople. Instead of spreading them everywhere equally, you put them where the money is.

Industry-Specific CLV Benchmarks

Here's what First Page Sage and others found:

- Tech/Software: Best CLV because of subscriptions and low costs

- Professional Services: Good CLV with 60-70% chance of repeat business

- Healthcare: Long relationships but takes forever to close deals

- Retail/E-commerce: All over the place depending on location

Knowing these helps you see if you're doing okay or if you need to fix something.

Scrap.io's Role in CLV-Optimized Prospecting

Real-Time Local Business Data

Old contact lists are like old milk – they might have been good once, but now they're useless. Scrap.io fixes this by pulling data straight from Google Maps and websites right now.

With 200 million businesses in their system worldwide, you're not using old crap. When a business updates their Google listing, you know immediately. Fresh data means better CLV math because you're using real info.

The Google Maps API cost calculator shows another win: way cheaper data. Instead of paying crazy API fees, you get everything for way less, making your CLV:CAC ratio look better.

Geographic Filtering and Segmentation

This is where Scrap.io gets really good for CLV work. You can filter by:

- Google Reviews: Find businesses with bad reviews who need help NOW (they pay more because they're desperate)

- Missing Social Media: Companies with email but no Instagram (easy digital marketing sale)

- Old Websites: Shows who needs updating

- Exact Location: Get data from specific neighborhoods or whole cities

Want Austin businesses with bad reviews and no social media? Two clicks. Need all dentists in Florida with weak online presence? Done. This targeting based on CLV signals changes everything.

Contact Quality Metrics

Bad data ruins CLV math. If half your emails bounce, your costs go up and conversions tank. That's why email validation for 95%+ deliverability is huge.

Scrap.io gives you multiple ways to reach each business – emails, phones, social profiles – all from public sources. More ways to reach people means better conversion rates and higher CLV.

CLV Success Stories in Local B2B Markets

Case Study: Software Services Company

Let me tell you about this software company that figured it out. They were spending the same on every lead, getting that average 21% conversion rate HubSpot talks about.

After using CLV targeting like Alex Hormozi's local business prospecting approach, they found something crazy. Restaurants and retail shops in the suburbs were worth 3x more than downtown corporations.

Why? Suburban businesses stayed longer, bought more stuff, and told their friends. They moved 70% of their budget to these high-CLV targets and made 150% more money in one year. Same budget, way better results.

Case Study: Marketing Agency Growth

Small marketing agency had the usual problems: clients leaving, unpredictable money, feast or famine. They decided to look at their CLV using sales prospecting techniques focused on phone calls.

What they found? B2B companies using video grew revenue 49% faster and stayed 2.5x longer. So they only went after video-ready businesses in three local markets. Results:

- 280% higher average CLV

- 45% lower CAC

- 6:1 CLV:CAC ratio (twice the recommended 3:1)

The secret was mixing CLV data with local focus and good tools.

Common CLV Mistakes in Local Prospecting

Short-Term Thinking Traps

Biggest mistake? Caring only about this month's sales and ignoring long-term value. They won't spend $5,000 to get a customer because it seems expensive, even though that customer might bring in $150,000 over five years.

Here's something crazy: you're 10x less likely to qualify a lead if you wait more than 5 minutes to respond. Wait 10 minutes instead of 5? 400% worse results. But companies ignore high-CLV prospects because they're chasing quick wins with cheap leads.

Another problem: the 7 common cold email mistakes that kill relationships before they start. Generic templates and bad timing might work for mass emails, but they suck for building real relationships with valuable customers.

Data Quality Issues

Bad data means bad decisions. If your CLV math is based on wrong info, you're basically guessing.

Common data problems:

- Not knowing where customers came from

- Forgetting to count extra purchases

- Putting all "agencies" in one group when they're totally different

- Having wrong contact info

Fix this with good data habits and the right cold email tools that give you accurate info from the start.

Future of CLV in Local B2B Prospecting

The future's already happening – just not everywhere yet. Companies using CLV for local prospecting are crushing competitors who still play the volume game.

AI Prediction: Computers are getting scary good at guessing CLV from tiny bits of info. Tell it a business's industry, size, location, and website, and it'll predict their lifetime value pretty accurately.

Real-Time CLV: Instead of checking CLV every few months, imagine seeing it change live. Move your sales team around based on what's happening right now.

Everything Connected: Mixing lead magnets for cold email with CLV data creates killer sales funnels. You're not just getting leads; you're getting the right ones.

Super Local Data: Soon we'll use stuff like foot traffic, local economy data, even weather to calculate CLV. A restaurant's value might change based on which side of the street they're on.

Conclusion: Building Sustainable Local B2B Growth

Here's the deal. Companies winning at local B2B prospecting aren't the ones with the most money or most leads. They're the ones who get that not all customers are worth the same.

When you mix customer lifetime value with local market knowledge, you stop wasting time on bad prospects. You stop competing on price with companies who don't get it. You stop treating every lead the same.

Instead, you build something that gets better over time. Each good customer you get helps you get the next one. You make more money. Your team stops running around like crazy and starts building real relationships.

The numbers are clear: 86% of salespeople say email prospecting works great when done right. Problem is most do it wrong – they spam everyone instead of targeting high-CLV prospects.

With platforms like Scrap.io giving you access to 200 million businesses in real-time, plus CLV strategies, you have everything you need to dominate local B2B markets. The question isn't whether to use CLV – it's how fast you can start before your competitors figure it out too.

Ready to change your local B2B prospecting with CLV? Try Scrap.io free and get your first 100 high-value prospects. Your future best customers are waiting.

FAQ: Customer Lifetime Value in B2B Prospecting

Q1: How do you calculate Customer Lifetime Value in B2B?

A: The basic formula is: CLV = (Average Revenue per Customer × Gross Margin %) ÷ Churn Rate. For B2B, include upsell revenues and longer relationship durations typical in business relationships.

Q2: What's the difference between CLV and CAC?

A: CAC (Customer Acquisition Cost) measures what you spend to acquire a customer, while CLV measures total value generated. The ideal CLV:CAC ratio is 3:1 or higher.

Q3: How do you use CLV for local prospecting?

A: Identify geographic segments and industries with highest CLV, then focus your prospecting efforts on these specific zones and business types.

Q4: How long does it take to see results from a CLV strategy?

A: First insights appear in 3-6 months, but full benefits of a CLV approach typically materialize over 12-18 months.

Q5: What tools should you use to track local CLV?

A: Combine CRM platforms (HubSpot, Salesforce), geographic prospecting tools (like Scrap.io), and analytics solutions for comprehensive tracking.